Optimize Your Earnings With Professional Guidance From an Organization Accountancy Advisor

By recognizing your unique business needs, they offer insights into budgeting, tax planning, and money flow management, ensuring that your financial sources are maximized for development. The actual question remains: exactly how can you determine the best consultant to lead you with the intricacies of economic decision-making and unlock your organization's full potential?

Recognizing the Duty of Bookkeeping Advisors

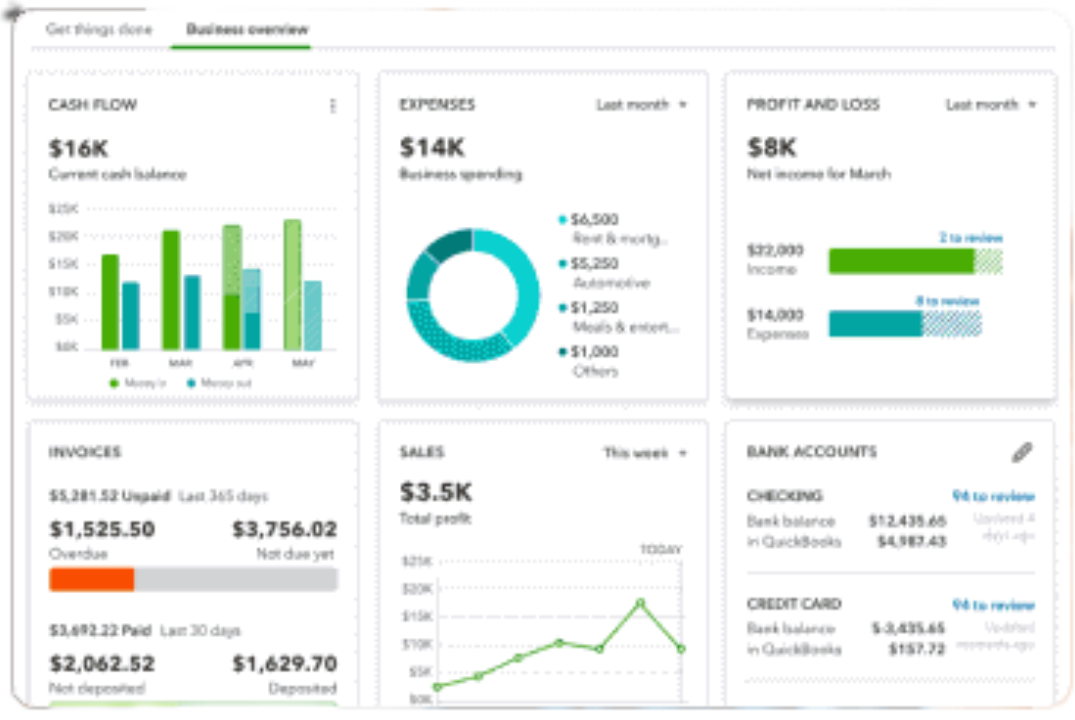

In addition, bookkeeping experts help in translating economic data, enabling business owners to understand their monetary placement and potential locations for development. They likewise play a significant function in budgeting and projecting, guaranteeing that companies allocate sources properly and plan for future costs (Succentrix Business Advisors). By suggesting on tax obligation strategies and compliance, these specialists assist decrease obligations and maximize financial end results

Additionally, accounting experts may help in recognizing cost-saving opportunities and boosting functional efficiency, which can cause boosted success. Their experience reaches providing understandings on investment decisions and risk management, guiding organizations towards lasting growth. In general, the role of accounting advisors is integral to fostering a strong economic structure, equipping services to prosper in an affordable environment.

Benefits of Specialist Financial Advice

Specialist economic support supplies many advantages that can dramatically boost a company's monetary technique. Engaging with a financial consultant supplies accessibility to specialist expertise and understandings, enabling services to browse complicated monetary landscapes better. This knowledge aids in making informed decisions regarding financial investments, budgeting, and expense monitoring, thereby optimizing source appropriation.

Furthermore, professional experts can determine potential threats and chances that might be neglected by in-house groups. Their unbiased perspective help in establishing robust financial projections, allowing companies to prepare for future growth and alleviate prospective troubles. Economic experts can help improve accountancy procedures, guaranteeing conformity with laws and reducing mistakes that can lead to financial charges.

Secret Providers Provided by Advisors

Among the important solutions given by monetary experts, calculated economic preparation sticks out as a vital offering for businesses seeking to boost their financial wellness. This involves thorough analysis and forecasting to straighten financial official source sources with long-term service objectives, making sure sustainability and development.

Furthermore, tax obligation planning is a crucial service that assists organizations navigate intricate tax guidelines and maximize their tax responsibilities. Advisors work to identify prospective reductions, credit histories, and techniques that decrease tax obligation burdens while making sure conformity with laws.

Capital management is one more crucial solution, where advisors assist in surveillance and optimizing cash inflows and discharges. Efficient capital management is essential for keeping liquidity and sustaining recurring operations.

Advisors likewise give monetary coverage and evaluation, delivering insights with thorough reports that allow company owner to make informed decisions. These records typically consist of essential efficiency indications and trend analyses.

Finally, threat management services are vital for recognizing potential economic threats and creating techniques to mitigate them. By dealing with these risks proactively, businesses can safeguard their properties and make certain lasting security. Collectively, these solutions empower businesses to make enlightened economic decisions and achieve their objectives.

Picking the Right Audit Expert

Choosing the best accounting advisor is a crucial choice that can dramatically affect a company's financial success. To make an enlightened option, consider a number of essential factors. To start with, examine the consultant's credentials and qualifications. A state-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or a professional with appropriate designations can provide guarantee of knowledge and compliance with regulations.

Furthermore, evaluate their experience within your sector. A consultant knowledgeable about your specific market will comprehend its distinct challenges and possibilities, allowing them to supply tailored guidance. Seek a person that shows a positive approach and has a performance history of aiding businesses attain their monetary objectives.

Interaction is critical in any advisory connection. Pick an advisor who prioritizes open and clear discussion, as this promotes an efficient partnership. see this here Furthermore, consider the array of solutions they use; an all-around expert can give understandings beyond basic accounting, such as tax obligation method and monetary forecasting.

Finally, count on your impulses. A strong relationship and shared worths are essential for a lasting collaboration. By taking these variables right into account, you can choose an accountancy consultant who will certainly not just satisfy your requirements however also add to your service's general growth and productivity.

Real-Life Success Stories

Effective companies often attribute their bookkeeping advisors as crucial players in their economic accomplishments. One noteworthy example is a mid-sized production firm that faced substantial cash circulation problems. By involving an audit consultant, the firm executed rigorous economic forecasting and budgeting strategies. This strategic support led to enhanced cash money administration, permitting the firm to purchase brand-new equipment, eventually improving manufacturing efficiency and productivity.

In an additional case, a start-up in the tech market was coming to grips with quick development and the intricacies of tax obligation conformity. The service got the know-how of an audit expert that structured their monetary procedures and developed a detailed tax obligation method. As an outcome, the start-up not just decreased tax obligation responsibilities yet additionally safeguarded added funding by providing a robust financial plan to investors, which considerably accelerated their growth trajectory.

These real-life success stories illustrate how the right bookkeeping expert can change economic obstacles into opportunities for development. By giving tailored understandings and approaches, these specialists my site empower businesses to optimize their monetary wellness, allowing them to accomplish their long-lasting objectives and make best use of profitability.

Final Thought

In verdict, the competence of a business audit expert proves vital for making the most of revenues and accomplishing lasting development. By providing tailored methods in budgeting, tax obligation preparation, and cash flow administration, these specialists empower businesses to navigate monetary intricacies effectively.

Bookkeeping experts play a vital duty in the financial health and wellness of an organization, providing vital advice on different economic matters.Furthermore, bookkeeping experts help in analyzing monetary information, allowing company owners to comprehend their economic placement and possible locations for development.Expert monetary assistance uses many benefits that can substantially improve a company's financial technique. Engaging with a financial advisor provides accessibility to expert expertise and understandings, enabling companies to browse intricate monetary landscapes a lot more properly. They can align financial planning with details organization objectives, making sure that every economic choice adds to the general tactical vision.

Comments on “Succentrix Business Advisors: A Relied On Call in Financial Management”